|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive Guide to Pet Insurance That Covers Existing IllnessPet insurance is an essential consideration for pet owners, especially when dealing with pre-existing conditions. Understanding the intricacies of such insurance can help ensure your furry friend receives the care they deserve without breaking the bank. Understanding Pre-Existing ConditionsPre-existing conditions refer to any health issues your pet had before obtaining insurance coverage. These can include chronic illnesses, previous injuries, or congenital issues. Types of Pre-Existing Conditions

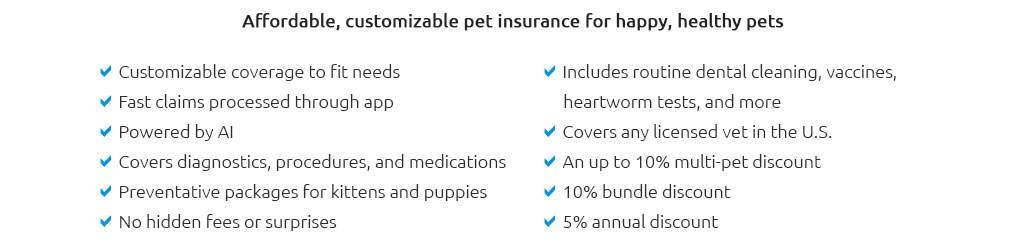

Choosing the Right Insurance PlanSelecting the best plan involves considering several factors to ensure it meets your pet's needs. Key Features to Look For

Exploring the best pet insurance ever reviews can provide insights into popular and reliable options. Benefits of Insuring Pets with Existing IllnessesWhile it may seem challenging, insuring a pet with pre-existing conditions offers several benefits.

For multi-pet households, checking out the best pet insurance for 2 cats might offer discounts or tailored plans. FAQChoosing the right pet insurance is crucial for managing existing health issues. By staying informed, you can make the best decision for your pet's future well-being. https://www.fetchpet.com/pet-insurance/pre-existing-conditions

Like other pet insurance providers, we do not cover pre-existing conditions. That being said, we do cover curable pre-existing conditions, and we're one of just ... https://www.petinsurance.com/whats-not-covered/

The good news is, not all pre-existing conditions are excluded permanently. If you have medical records from your vet showing that your pet's condition has been ... https://www.pawlicy.com/blog/pre-existing-conditions/

Will pet insurance cover pre-existing conditions? There are no pet insurance plans that cover pre-existing conditions. If a condition is diagnosed before your ...

|